Aspo is in constant motion – to reach its destination and stay up to speed

To accomplish a far-reaching vision demands an ability to maintain a strong presence and follow current trends. The impact of choices made today reach far into the future. Aspo’s vision is to increase the company’s value and expertise in the long term. Thanks to its long history, Aspo has a thorough strategic understanding of the operating environment and any changes in it.

The year 2016 was the beginning of a new and more determined four-year period. The solutions we make today lead Aspo towards 2020. The way has been charted to reach set targets. Aspo is in a new era, being ever more rooted to the present day – a unique conglomerate in a changing world.

Aspo is a conglomerate that specializes in demanding B-to-B customers. It owns and develops its businesses in Northern Europe and in selected growth markets. Aspo’s wholly owned subsidiaries ESL Shipping, Leipurin, Telko and Kauko operate under their own strong brands and provide value for their customers. The objective of the trade and logistics businesses is to be the market leaders in their sectors. Aspo’s value is produced by the entity formed by its businesses.

Aspo’s vision is to increase the value and competence of the company over the long term, from generation to generation.

Aspo owns, leads and develops its business operations and Group structure for the long term without any predefined schedules.

Every year, Aspo distributes at least half of the annual profit in dividends on average. Average dividend yield in 2007–2016

6.3%

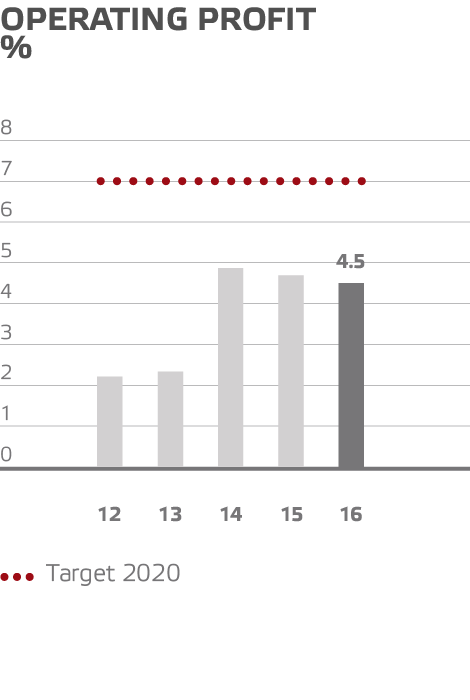

ASPO AIMS TO REACH THE FOLLOWING FINANCIAL TARGETS BY 2020:

7%

20%

100%

457.4 M€

445.8 M€ (2015)

NET SALES

20.4 M€

20.6 M€ (2015)

operating profit

Aspo aims to reach its long-term financial targets by 2020.

7%

ASPO IS ABLE TO REACH ITS OPERATING PROFIT TARGET OF SEVEN PERCENT, ABOVE ALL, BY INVESTING IN THE DEVELOPMENT OF ITS CUSTOMER ACCOUNTS AND SETTING UP A PRODUCT AND SERVICE RANGE WITH A HIGHER MARGIN.

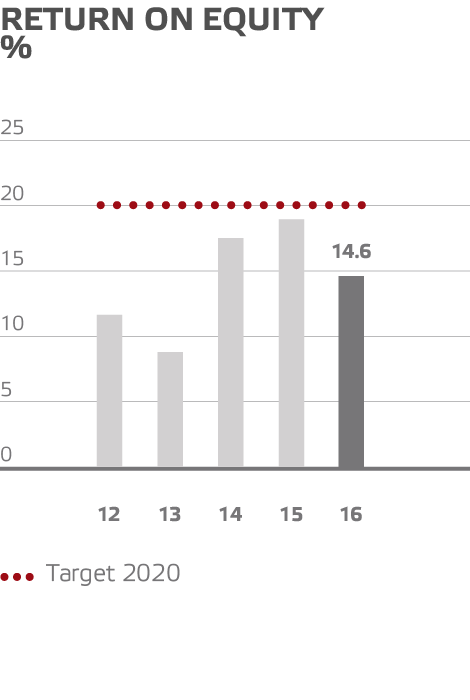

20%

ASPO'S OBJECTIVE IS TO REACH AN EXCELLENT ROE LEVEL OF OVER 20 PERCENT ON AVERAGE.

100%

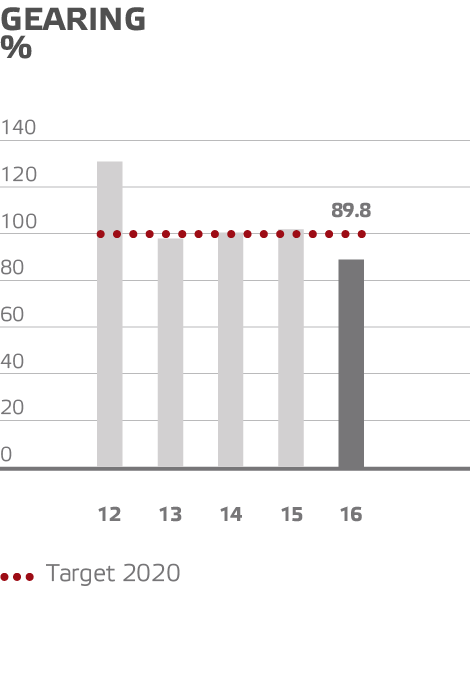

ASPO'S TARGET IN TERMS OF GEARING IS AT MOST 100 PERCENT. BEING A CONGLOMERATE, ASPO IS MORE RESISTANT TO INDEBTEDNESS THAN COMPANIES BEARING HIGHER RISKS, AND IT UTILIZES LEVERAGE IN ITS OPERATIONS.

To speed up the development and growth of Leipurin, Mikko Laavainen was appointed the company's new Managing Director. He has a proven track record in the development of solution operations in the international food market. The future development of Leipurin will lean on solid expertise in industrial banking, and also on the Out-of-Home market.

Aspo's Board of Directors proposed that a twice-a-year distribution policy be adopted starting from 2017.

Traditional Kaukomarkkinat changed its name to Kauko. From now on, the company will focus on mobile IT for demanding conditions, healthcare, industry, trade and different logistics tasks. The company specializes, for example, in customized software and hardware solutions for hospitals and healthcare centers.

Aspo Group specified the time period for reaching its long-term financial targets. The company is looking for an average ROE of over 20 percent, gearing of up to 100 percent and an operating profit rate of 7 percent with the current structure by 2020.

ESL Shipping expects its net sales to grow and its operating profit to increase to a level of 20–24 percent by 2020. The company is looking for growth from the additional capacity offered by its vessel investments, a larger customer base and the opportunities presented by new business areas. The company can improve its profitability, for example, through its energy-efficient vessels.

In 2016, Telko produced the highest net sales in its history. In addition to organic growth, Telko continued to expand geographically by establishing a subsidiary in Azerbaijan. Growth in Finland strengthened by the launch of the Castrol automotive motor oil business.

The two new vessels are the most effective large bulk carriers in the world in terms of their fuel economy and level of technology. Their CO2 emissions are more than 50% lower compared with current vessels.

The four-year period that has been set to reach the Group’s long-term financial targets ends. With its current structure, the company is looking for an operating profit rate of 7%, ROE of over 20% on average and gearing of up to 100%.

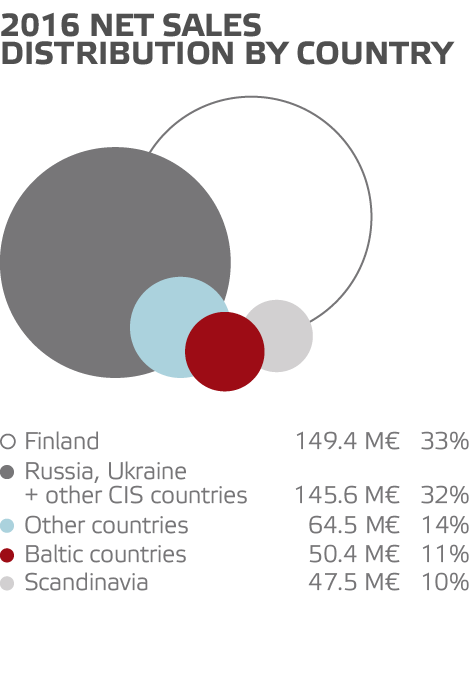

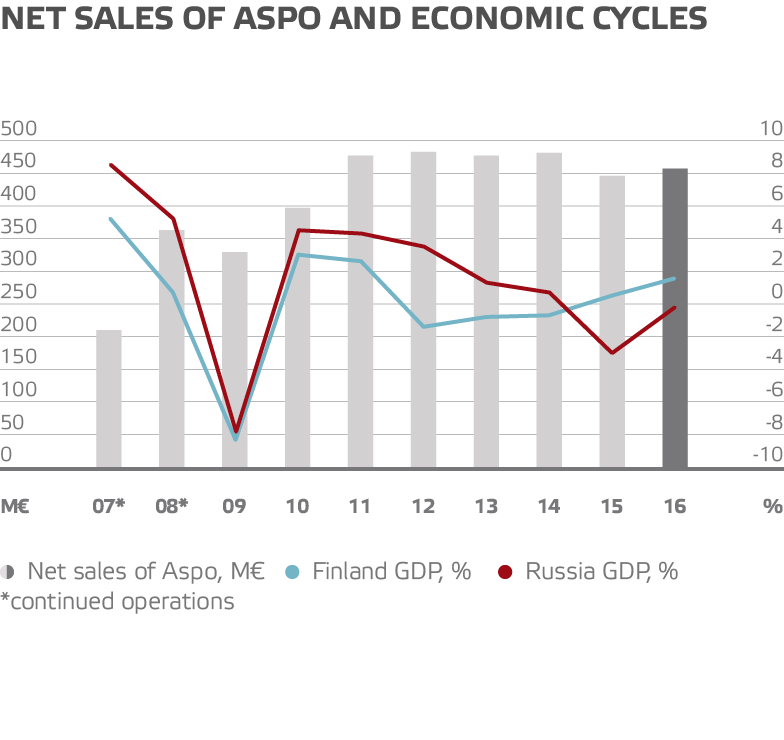

Uncertainty over the global economy reflected in Aspo’s operating environment, particularly in demand for basic raw materials and in low raw material prices. International dry bulk cargo prices remained unusually low in 2016. Despite the challenging circumstances, Aspo was able to produce good results in the eastern market.

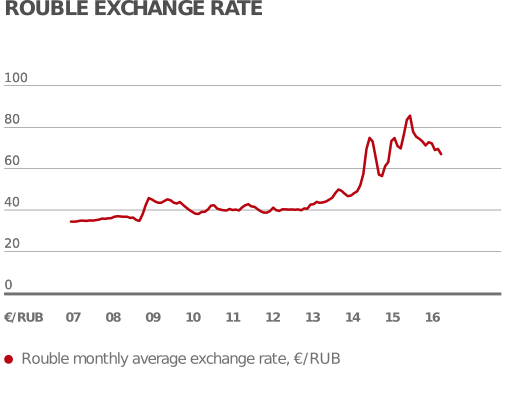

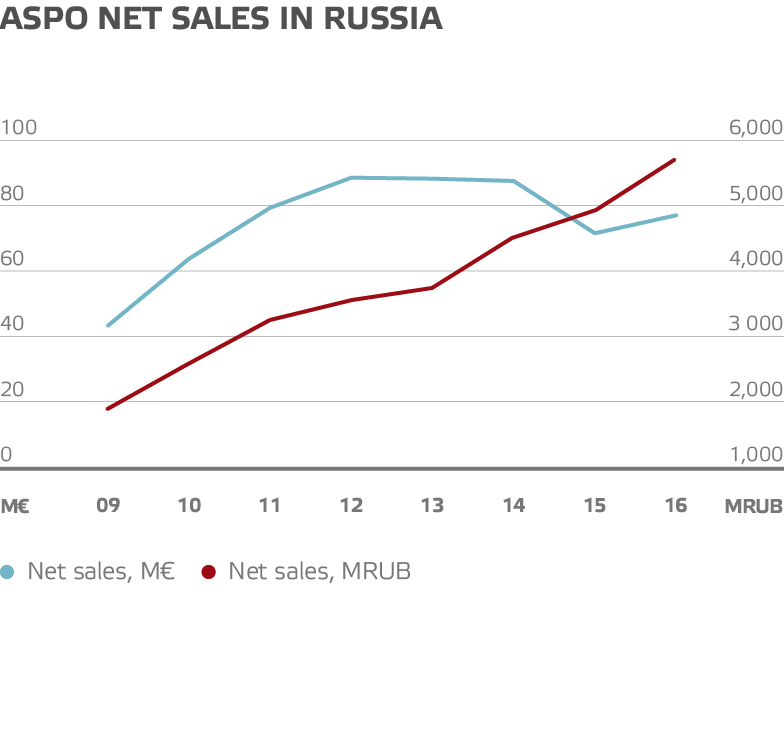

Aspo has worked hard to reach its current strong position in eastern markets. Understanding the eastern market requires a broad vision, across individual quarters and temporary cycles. Aspo’s growth in the eastern market is generated from organic expansion both into new product and service segments and new market areas. Regardless of the general uncertainty, there were positive signs in the developmet of Russian and the eastern markets in 2016. The decrease in the Russian economy decelerated, and it is expected to turn towards an increase in 2017.

The climate change, a carbon-free Helsinki and emphasized environmental sustainability have strongly shaped the operations of ESL Shipping. It is one of the first shipping companies to operate in the Northern Sea Route, and it has also quickly reacted to the crash in coal imports by investing in the transportation of bioenergy. The environmental sustainability of ESL Shipping will rise to a new level when its new LNG-fueled vessels start operating in 2018. Supported by these new vessels, ESL Shipping expects its net sales to grow and its operating profit to increase to a level of 20–24 percent by 2020.

+15.9%

In Russia, ruble-denominated net sales increased. (2016)

+20.3%

The value of ruble increased. (2016)

+101%

Baltic Dry index increased but remained low. (2016)

-0.2%

Russia's GDP declined. (2016)

ESL Shipping is the leading carrier of dry bulk cargoes in the Baltic Sea region. Its purpose is to ensure raw materials for the industries and energy production throughout the year, even in difficult climate conditions.

Net sales (2016)

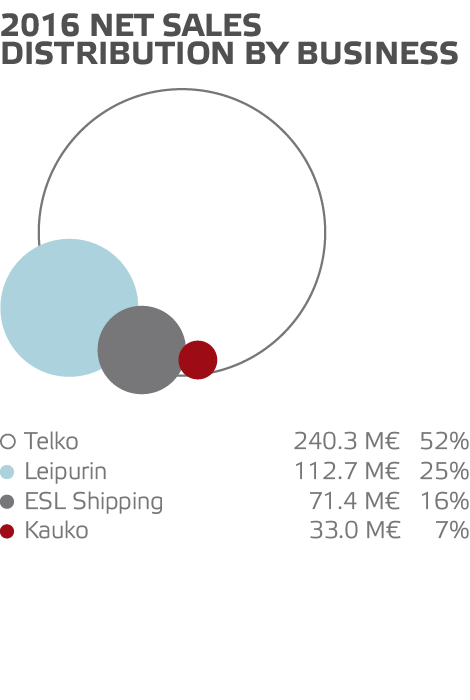

71.4 M€

Operating profit (2016)

12.6 M€

Target ebit

20–24%

Leipurin produces solutions for bakery and confectionery products, the food industry and Out-of-Home markets. The company provides its customers with total concepts, R&D services, raw materials and machines.

Net sales (2016)

112.7 M€

Operating profit (2016)

2.0 M€

Target ebit

7%

Telko is a leading expert and supplier of plastic raw materials and industrial chemicals. Its extensive customer service also covers technical support and the development of production processes. Telko represents leading international principals in the industry.

Net sales (2016)

240.3 M€

Operating profit (2016)

10.1 M€

Target ebit

7%

Kauko specializes in customized hardware and software solutions for demanding field conditions and critical social functions. The company is also the leading supplier of solutions that improve energy efficiency.

Net sales (2016)

33.0 M€

Operating profit (2016)

-0.1 M€

Aspo has the will, skills and resources to develop its businesses in the light of its far-reaching strategic vision. Aspo’s key objective is to increase and internationalize medium-sized companies.

Operating in multiple fields enables a steady development of profit and diversified risks. Operating in several different countries also diversifies risks.

Aspo has a unique character. Aspo is a combination of the characteristics of a conglomerate and a holding company: It wholly owns its thoroughly selected businesses operating in different fields, it relies on external Boards of Directors in terms of leadership, and it partly channels funding through the parent company and partly directly to specific businesses.

FOR FURTHER INFORMATION, CONTACT US

Aki Ojanen

Chief Executive Officer

+358 9 521 4010

aki.ojanen@aspo.com

Harri Seppälä

Group Treasurer

+358 9 521 4035

harri.seppala@aspo.com