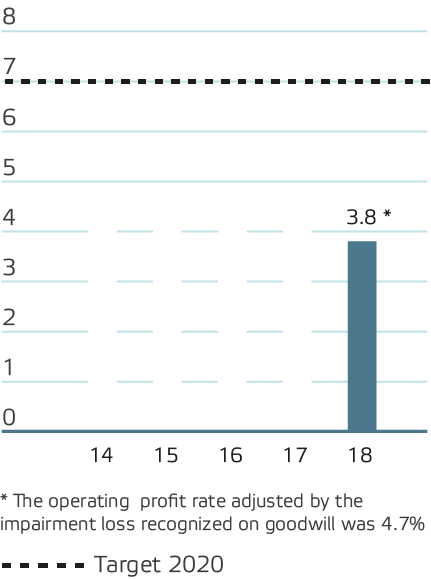

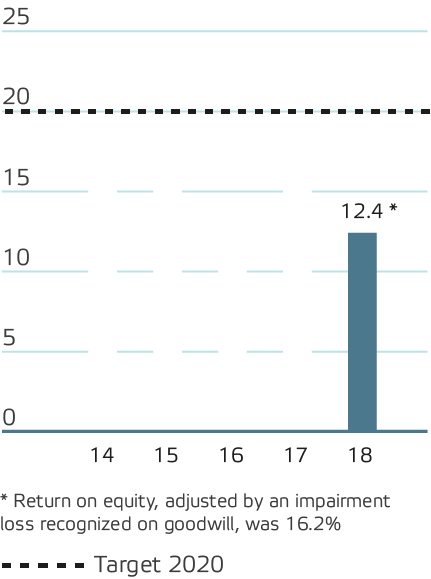

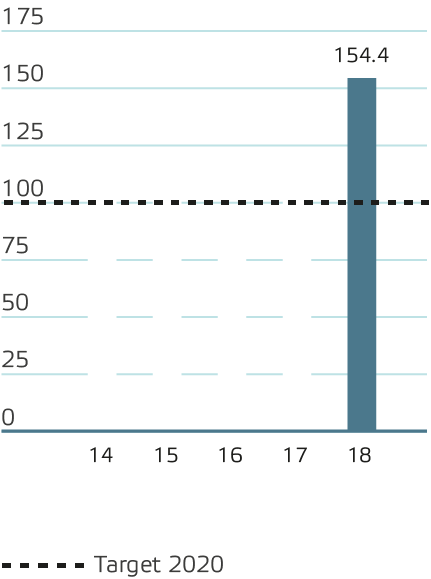

Key figures 2018

2018 was a year of good growth for Aspo, and we made the best operating profit in our history before the impairment loss recognized on goodwill. The shipping company’s new vessels and the business acquisition completed in Sweden, combined with investments in expanded operations, for example in Central Asia, enabled Aspo’s strong financial development to continue and indebtedness to decrease.