Aspo navigates in a changing world

– and sets its eyes firmly on the future.

The four-year period Aspo started in 2016 has moved forward with determined steps, and in 2017, the value of conglomerate Aspo developed positively. Reaching the targets set for the future continues to require focus. Having a vision and setting goals, together with closely planned activities, enable the development of Aspo's value, also in the future.

The financial targets set clarify the long-term vision of the conglomerate even further. These financial goals are based on continuous learning and increased strategic understanding. New requirements set by the changing environment are at the focal point of the strategy and operations.

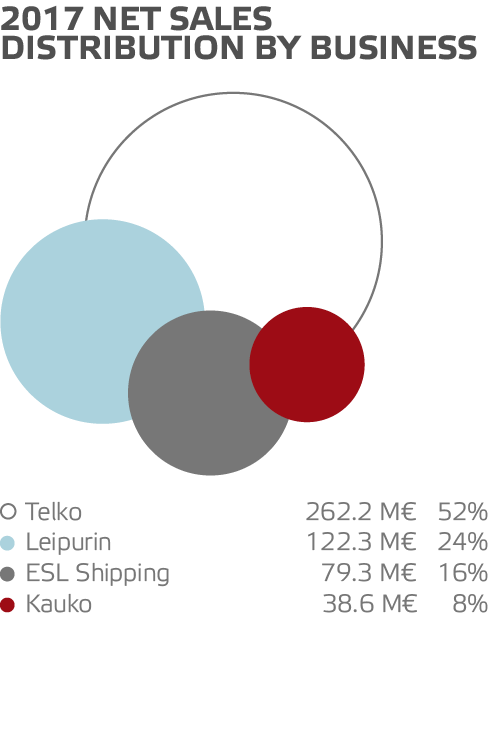

Aspo is a conglomerate that specializes in demanding B-to-B customers. It owns and develops its businesses in Northern Europe and in selected growth markets. Aspo's wholly owned subsidiaries ESL Shipping, Leipurin, Telko and Kauko operate under their own strong brands and provide value for their customers. The objective of the trade and logistics businesses is to be the market leaders in their sectors. Aspo's value is produced by the entity formed by its businesses.

Aspo's vision is to increase the value and competence of the company from generation to generation.

Aspo owns, leads and develops its business operations and Group structure for the long term without any predefined schedules.

Every year, Aspo distributes at least half of the annual profit in dividends on average. Average dividend yield in 2006–2017:

6.1%

502.4 M€

457.4 M€ (2016)

net sales

23.1 M€

20.4 M€ (2016)

operating profit

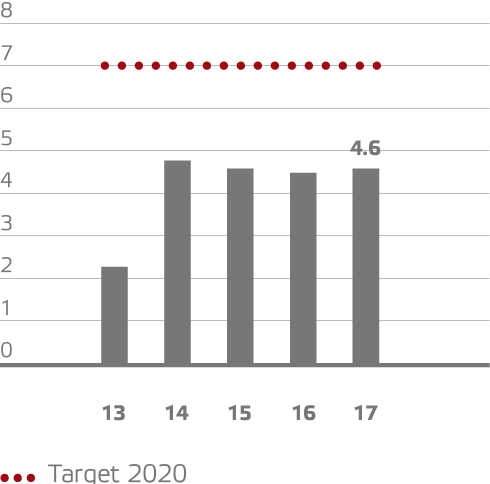

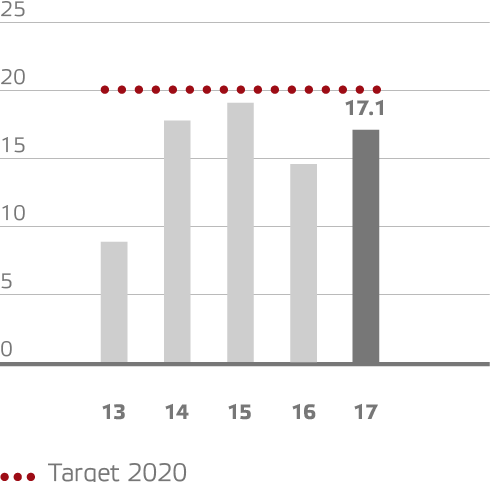

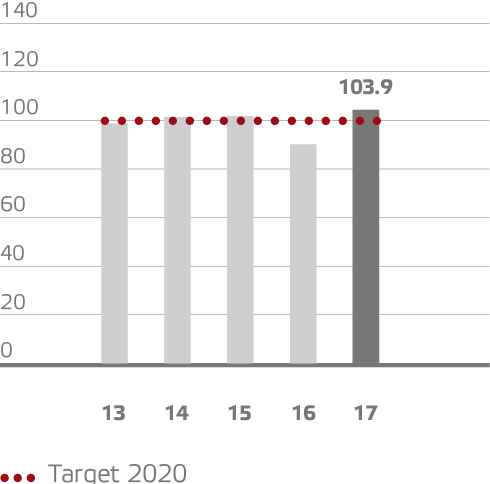

Aspo is committed to reaching its long-term financial targets by 2020.

7%

ASPO IS ABLE TO REACH ITS OPERATING PROFIT TARGET OF SEVEN PERCENT, ABOVE ALL, BY INVESTING IN THE DEVELOPMENT OF ITS CUSTOMER ACCOUNTS AND SETTING UP A PRODUCT AND SERVICE RANGE WITH A HIGHER MARGIN.

20%

ASPO'S OBJECTIVE IS TO REACH AN EXCELLENT ROE LEVEL OF OVER 20 PERCENT ON AVERAGE.

100%

ASPO'S TARGET IN TERMS OF GEARING IS AT MOST 100 PERCENT. BEING A CONGLOMERATE, ASPO HAS LOW BUSINESS RISKS AND IS MORE RESISTANT TO INDEBTEDNESS THAN COMPANIES BEARING HIGHER RISKS, AND IT UTILIZES LEVERAGE IN ITS OPERATIONS.

Starting from March 1, 2017, the following members were appointed to the Board of Directors of Telko, in addition to the chairman of the company's Board of Directors: Anders Dahlblom, Vice President and Managing Director of Paroc Group Oy; Elina Piispanen, Chief Transformation Officer at Sanoma Media Finland; and Irmeli Rytkönen, CEO of Gigantti Oy Ab.

Leipurin has served its customers for 100 years, starting from the early days of Finland's independence. Leipurin's future activities are based on its original roots: customer-driven operations. According to its new growth strategy, Leipurin will serve not only bakery customers, but also customers in the out of home (OOH) market.

In spring 2017, Aspo shifted to a practice of paying dividends in two installments. This practice will help Aspo to improve its cash flow management, produce steadier cash flow to its shareholders and reduce volatility of the share price. The first installment of dividends of EUR 0.42 was paid in April and an equal installment was paid in November.

Kauko's solar power business grew strongly. In May, the 1,000th system delivery of the year was installed. The sales volume at the beginning of the year equaled the volume of solar power systems delivered by the company in 2016. The total output of 1,000 solar power systems covers the electricity consumption of roughly 200 detached houses in a year.

ESL Shipping's new eco-friendly dry cargo vessel was named Viikki in a ceremony held in Nanjing, China, in June. The 160-meter LNG-fueled vessel of 26,000 dwt produces more than 50% less carbon dioxide than the previous vessel generation.

As planned, Telko started operations in the Middle East in order to acquire raw materials and start to sell special technical products.

Leipurin sold its raw material operations for the meat industry to MP Maustepalvelut Oy, part of the Dutch Barenz Group.

Tomi Tanninen (M.Sc. Econ.) was appointed new CFO of Telko starting from September 1, 2017.

ESL Shipping's second LNG-fueled dry cargo vessel was named Haaga at the Jinling shipyard in Nanjing, China, in September. It will start operating, together with its sister ship Viikki in the Baltic Sea during the first half of 2018.

Telko's new goals were announced at Aspo's investor event. Telko estimated its net sales to be at EUR 300–350 million and operating profit at 6–7 percent by the end of 2020.

Kauko decided to discontinue its project operations in Beijing during the fourth quarter. After discontinuing its operations in China, Kauko will have operations in Finland and Germany.

The two new vessels are the most effective large bulk carriers in the world in terms of their fuel economy and level of technology. Their CO2 emissions are more than 50% lower compared with current vessels.

The four-year period that has been set to reach the Group’s long-term financial targets ends. With its current structure, the company is looking for an operating profit rate of 7%, ROE of over 20% on average and gearing of up to 100%.

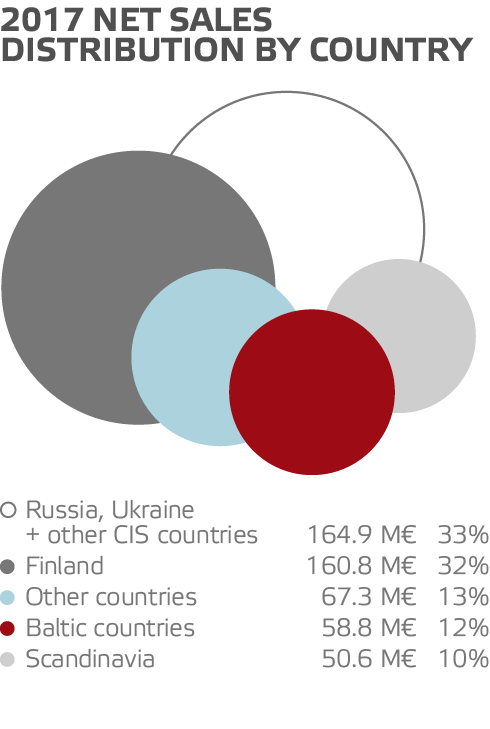

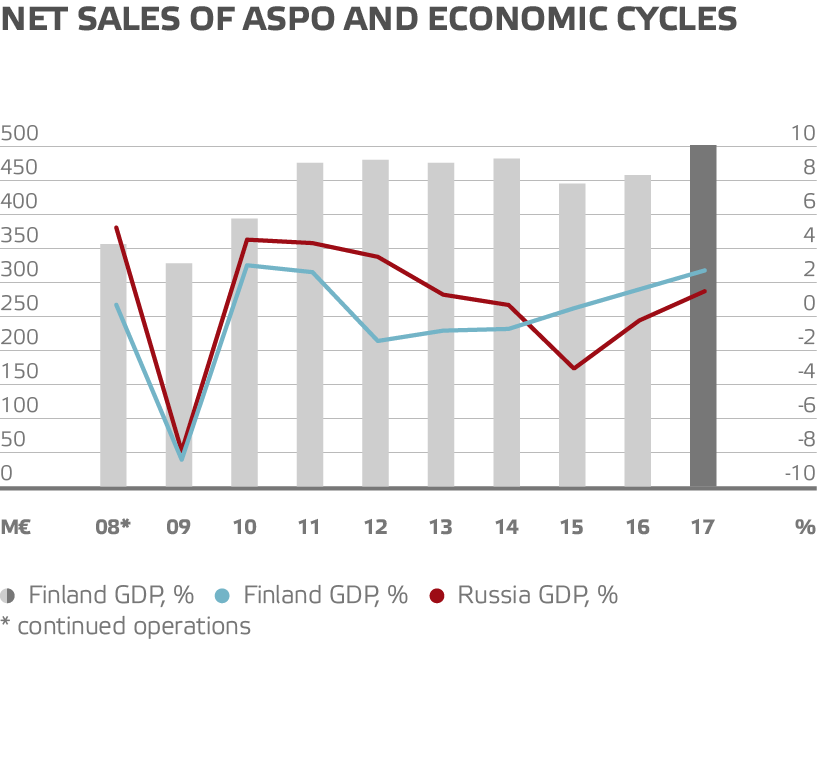

The global economy improved in 2017. What is more, economic growth in the EU and in Finland accelerated, export volumes grew and investments started to increase. Industrial production went up in the main market areas of Aspo's businesses. Towards the end of 2017, the Russian market and global sea freight markets, which are important to Aspo, started to return to the normal market situation.

The exchange rate of the Russian ruble in relation to the euro evened out at the end of 2017. The price of oil remained unchanged and the prices of production raw materials stayed low. The general market prices of dry bulk cargo increased slightly, while cargo prices remained at a fairly low level.

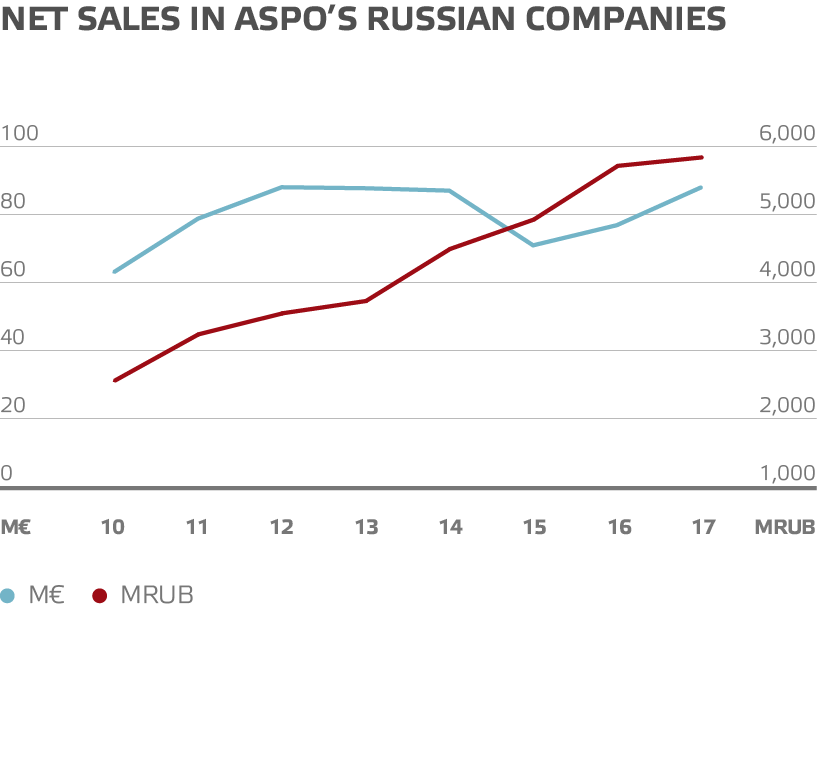

+14%

Ruble -denominated net sales' growth of Aspo's Russian companies (2009-2017)

-9.3%

Value of ruble decreased (2017)

+42%

Baltic Dry index increased, but remained low (2017)

+1.5%

Russia's GDP strengthened (2017)

Ensuring responsibility is of primary importance for securing the long-term development of Aspo. In the sectors of Aspo’s businesses, the main aspects related to corporate responsibility concern the reduction of energy consumption and emissions, wellbeing and safe working conditions of personnel, equality and good governance. Read more

ESL Shipping is the most capital-intensive and profitable business in the Aspo Group.

The growth and profitability of Leipurin are clearly returning to the level before the 2014 economic crisis in Russia.

Telko’s business does not tie down significant capital, and the profitability and cash flow are also at a good level.

ESL Shipping is the leading shipping company transporting dry bulk cargo in the Baltic Sea region. Its purpose is to ensure raw materials for the industries and energy production throughout the year, even in difficult weather conditions.

2017

net sales

79.3 M€

operating profit

13.5 M€

Operating profit %

17.0%

Leipurin produces solutions for bakery and confectionery products, the food industry and Out-of-Home markets. The company provides its customers with total concepts, R&D services, raw materials and machines.

2017

net sales

122.3 M€

operating profit

3.1 M€

OPERATING PROFIT %

2.5%

Telko is a leading expert and supplier of plastic raw materials and industrial chemicals. Its extensive customer service also covers technical support and the development of production processes. Telko represents leading international principals in the industry.

2017

net sales

262.2 M€

operating profit

10.8 M€

OPERATING PROFIT %

4.1%

Kauko specializes in customized hardware and software solutions for demanding field conditions and critical social functions. The company is also the leading supplier of solutions that improve energy efficiency.

2017

net sales

38.6 M€

operating profit

-0.2 M€

OPERATING PROFIT %

-0.5%

Aspo has the will, skills and resources to develop its businesses in the light of its far-reaching strategic vision. Aspo's key objective is to increase and internationalize medium-sized companies.

Operating in multiple fields enables a steady development of profit and diversified risks. Operating in several different countries also diversifies risks.

Aspo wholly owns its thoroughly selected businesses operating in different sectors, it relies on external Boards of Directors in terms of leadership, and it partly channels financing through the parent company and partly directly to specific businesses. Investors should not regard Aspo as a holding company – it is an industrial conglomerate, regardless of its unique structure.

FOR FURTHER INFORMATION, CONTACT US

Aki Ojanen

Chief Executive Officer

+358 9 521 4010

aki.ojanen@aspo.com

Harri Seppälä

Group Treasurer

+358 9 521 4035

harri.seppala@aspo.com