Aspo Direction

Annual Report 2015

Aspo in brief | Core of a conglomerate | Operating enviroment | Case ESL,Telko and Leipurin | Strategy | Profit | Materials

The Aspo Direction sets up the conglomerate on a solid and determined base. We have the will, skills and resources to develop our businesses in the light of our far-reaching strategic vision.

Our success is and will be in our own hands. Our new strategic guidelines prove that we are also ready to boldly implement strategic changes of direction. Being the only listed conglomerate in Finland, we are in a unique position. Operating in multiple fields enables

a steady development of profit and diversified risks.

We have proven that we can succeed despite the challenging market situation.

We believe that Aspo will rise to an even higher level in the future.

Aspo in brief

2015

445.8 M€Net sales

|

20.6 M€Operating profit

|

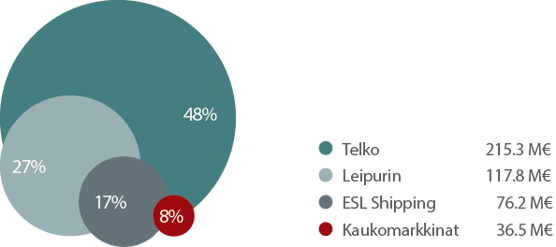

Net sales distribution by business

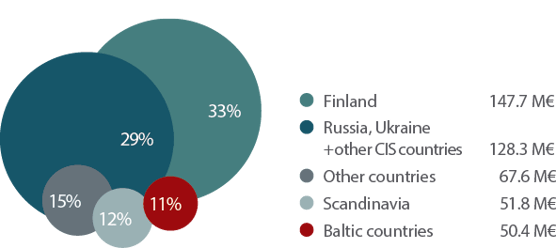

Net sales distribution by country

VISION

ASPO’S VISION IS TO INCREASE THE VALUE AND COMPETENCE OF THE COMPANY OVER THE LONG TERM, FROM GENERATION TO GENERATION.

STRATEGY

ASPO OWNS, LEADS AND DEVELOPS ITS BUSINESS OPERATIONS AND GROUP STRUCTURE FOR THE LONG TERM WITHOUT ANY PREDEFINED SCHEDULES.

FINANCIAL TARGETS

ASPO IS COMMITTED TO REACHING ITS LONG-TERM FINANCIAL TARGETS:

Operating profit with current structure

7%

Average return on equity of over

20%

Gearing of up to:

100%

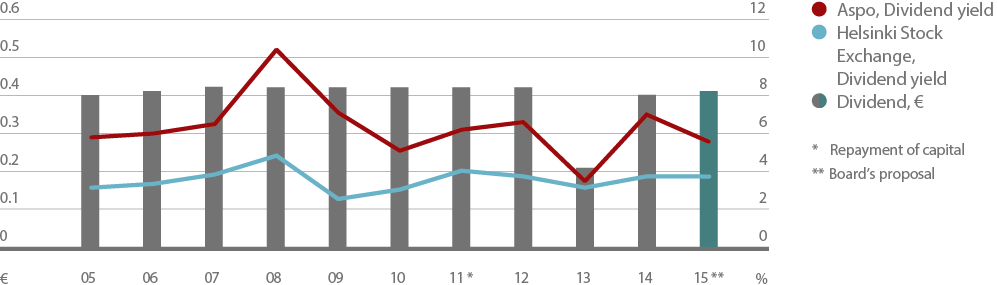

ACTIVE DIVIDEND POLICY

ASPO DIVIDEND YIELD, AVERAGE 2006–2015 Helsinki Stock Exchange, average 3.7%

6.4%

A RESPECTED SPECIALIST IN ITS BUSINESS FIELDS

Aspo’s wholly owned subsidiaries ESL Shipping, Leipurin, Telko and Kaukomarkkinat operate under their own brands and provide value for their customers. The businesses are engaged in trade and logistics. Aspo’s value is created by the entity formed by the subsidiaries.

The leading dry bulk cargo company operating in the Baltic Sea region. ESL Shipping takes care of its customers’ vital raw material transportation, even in difficult weather conditions. The company also offers loading and unloading services at sea.

A concept supplier for the bakery and food industry. Leipurin provides its customers with total concepts, R&D services, raw materials and machinery.

An expert in industrial raw materials. Telko is a supplier of plastic raw materials, industrial chemicals and lubricants to B-to-B customers.

A solution provider for demanding work environments and mobile knowledge work. Kaukomarkkinat provides its customers with tailored hardware and software solutions and life cycle services.

Customers

- Steel industry

- Energy industry

- Mining industry

- Bakery industry

- Out-of-Home customers

- Retail

- Plastic industry

- Paint industry

- Printing and packaging industry

- Medical industry

- Healthcare sector

- Industry

- Logistics and trade

- Authorities and safety

Strenghts

- Superior fleet for ice conditions

- Self-loading and -unloading vessels

- Vessels tailored for customers’ ports

- Leading market position in industrial

baking in Northern Europe and Russia - Extensive geographical coverage

- Extensive test bakery chain

- Leading principals and extensive product range

- Local sales organizations

- Leading position, particularly in eastern markets

- Solid expertise in the raw materials required in the production processes of customers

- Global procurement organization and local warehouses

- The ability to create overall solutions

for various customer needs - Extensive references and good

relationships with principals - Effective scalability of solutions

Key figures

NET SALES 76.2 M€

OPERATING PROFIT 14.7 M€

PERSONNEL 223

NET SALES 117.8 M€

OPERATING PROFIT 2.4 M€

PERSONNEL 299

NET SALES 215.3 M€

OPERATING PROFIT 10.4 M€

PERSONNEL 265

NET SALES 36.5 M€

OPERATING PROFIT -1.2 M€

PERSONNEL 46

1

FORMING A BALANCED WHOLE WITH DIVERSIFIED CASH FLOWS ACCORDING TO BOTH BUSINESS AND GEOGRAPHICAL REGION.

2

SETTING UP A STRUCTURE WHICH BALANCES FLUCTUA-TIONS IN ECONOMIC SITUATIONS BECAUSE OF CYCLES THAT DIFFER FROM ONE SUBSIDIARY TO THE NEXT.

3

ENABLING LARGER INVEST-MENTS WHICH SINGLE BUSINESSES WOULD NOT NECESSARILY HAVE THE PREREQUISITES FOR.

4

OFFERING AN EXTENSIVE STRATEGIC UNDERSTANDING OF THE OPERATING ENVIRONMENT.

5

PERFORMING LONG-TERM DEVELOPMENT WORK ACROSS GENERATIONS.

OPERATING ENVIRONMENT

SUCCESS IN CHALLENGING MARKETS

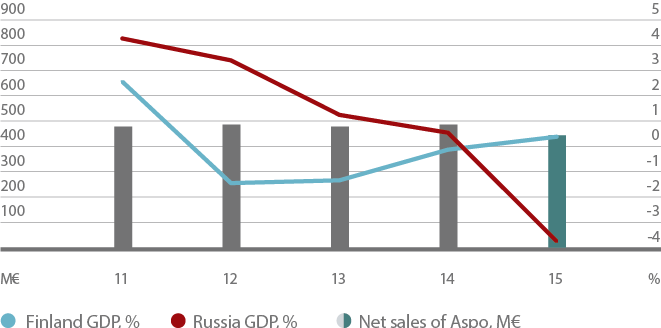

Net sales of Aspo and economic cycles

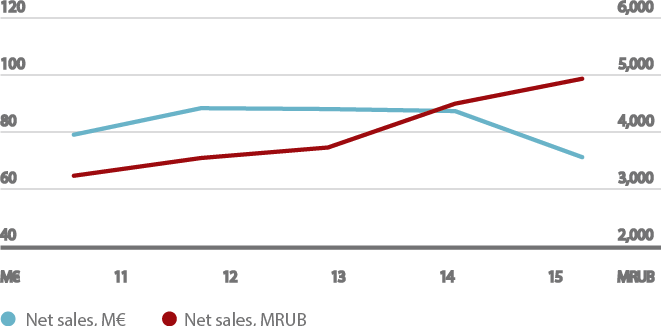

Aspo net sales in Russia

+9.6%

In Russia, ruble-denominated net sales increased. (2015)

-11.5%

The value of ruble declined. (2015)

-38.5%

Baltic Dry Index drops to all-time low. (2015)

-3.7%

Russia´s GDP declined. (2015)

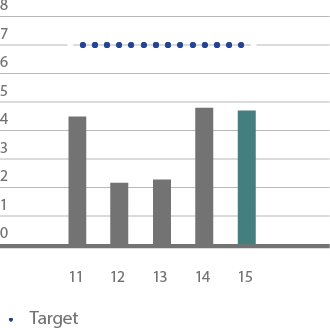

OPERATING PROFIT %

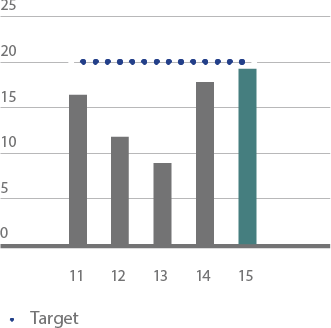

RETURN ON EQUITY %

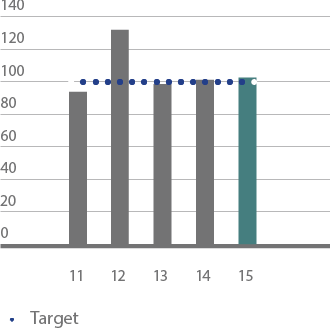

GEARING %

GENEROUS DIVIDEND PAYER

WHY INVEST IN ASPO?

1

DIVERSIFIED RISK

ASPO’S CASH FLOWS ARE DIVIDED BETWEEN FOUR DIFFERENT BUSINESSES

WITH DIFFERENT CUSTOMERS AND CYCLES. OPERATING

IN SEVERAL DIFFERENTCOUNTRIES ALSO DIVERSIFIES RISKS.

2

HIGH RETURN ON EQUITY

ASPO’S OBJECTIVE IS TO REACH AN EXCELLENT ROE LEVEL OF MORE THAN 20 PERCENT.

3

GENEROUS DIVIDEND PAYER

ASPO’S AVERAGE DIVIDEND YIELD BETWEEN 2006 AND 2015 IS 6.4 PERCENT, WHILE THE CORRESPONDING AVERAGE OF COMPANIES LISTED ON THE HELSINKI STOCK EXCHANGE OVER THE SAME PERIOD IS 3.7 PERCENT.

4

MARKET LEADER IN ITS BUSINESS FIELDS

THE AIM OF EACH SUBSIDIARY OF ASPO IS TO BE THE MARKET LEADER IN THEIR SPECIFIC BUSINESS FIELD AND TO GROW FASTER THAN THE MARKET.

5

SUCCESS IN EASTERN MARKETS

DESPITE THE CHALLENGING MARKET SITUATION, ASPO HAS BEEN ABLE TO MAINTAIN ITS HIGH PROFITABILITY IN THE EASTERN MARKETS, WITH AN OPERATING PROFIT OF 7 PERCENT. RUSSIA AND EASTERN GROWTH MARKETS CONTINUE TO ENABLE STRONG ORGANIC GROWTH.

6

A UNIQUE CHARACTER

ASPO IS A COMBINATION OF THE CHARACTERISTICS OF A CONGLOMERATE AND A HOLDING COMPANY: IT WHOLLY OWNS ITS THOROUGHLY SELECTED BUSINESSES OPERATING IN DIFFERENT FIELDS, IT RELIES ON EXTERNAL BOARDS OF DIREC-TORS IN TERMS OF LEADER-SHIP, AND IT PARTLY CHANNELS FUNDING THROUGH THE PARENT COMPANY AND PARTLY DIRECTLY TO SPECIFIC BUSINESSES.